How to Buy a Car in the UK: A Comprehensive Guide

5 October 2023

Are Electric Cars Worth It?

19 October 2023When you own a vehicle, there are several costs and responsibilities that you need to take into account. A cost that frequently causes confusion among people is the Vehicle Excise Duty, also known as VED.

In this comprehensive article, we will delve into the concept of VED, exploring its history, mechanics, and the impact it has on vehicle owners. By the end of this, you will have a thorough understanding of what VED is and how it impacts you.

In this article

ShowHide- Understanding Vehicle Excise Duty (VED)

- History of VED

- Who Pays Vehicle Excise Duty?

- How VED is Calculated

- Different Vehicle Tax Bands

- Overview of the VED rates for different vehicle categories

- FAQs about VED

- What is the reason behind implementing Vehicle Excise Duty?

- How is the VED is calculated?

- Are there any exemptions for VED?

- Is Vehicle Excise Duty the Same as Car Tax?

- Can I Pay Vehicle Excise Duty Monthly?

- What will happen if I fail to pay my VED on time?

- Can I Transfer VED to Another Vehicle?

- What is the impact of VED on the environment?

- Conclusion On VED

Understanding Vehicle Excise Duty (VED)

Vehicle Excise Duty, commonly known as car tax or road tax, is essentially a tax that is levied on road vehicles used or kept on public roads such as cars, motorcycles, and vans. Its purpose is to help fund the upkeep and maintenance of the country's road network. In addition, the UK government uses VED as a way to not only raise revenue, but to encourage the use of more environmentally friendly vehicles. In the UK, it is mandatory for all vehicles that are driven or parked on public roads to comply with legal requirements.

History of VED

The history of VED is quite fascinating, as it stretches all the way back to 1888 in the early 20th century. Initially, it was introduced as a way to finance the development of road infrastructure and regulate the increasing number of vehicles on the roads.

Back then, it was known as the "Locomotive Act." Over the years, the tax evolved and was renamed the "Road Fund License." Today, it is referred to as Vehicle Excise Duty.

Who Pays Vehicle Excise Duty?

In the UK, every vehicle owner or user is obligated to pay VED. This applies to all individuals, businesses, and organisations, regardless of whether they use the vehicle for personal or commercial reasons. It's important to note that electric vehicles (EVs) are often exempt from VED.

How VED is Calculated

The VED is not a fixed amount but is calculated based on several factors, such as the emissions of the vehicle, the type of fuel it uses, and the date of purchase. It's important to have a clear understanding of how VED is calculated, as it can help you accurately assess your tax liability. The rates for VED can change annually, so it's essential for vehicle owners in the UK to check the current rates and requirements with the Driver and Vehicle Licensing Agency (DVLA) or on the official government website to ensure they are compliant with the law.

Failure to pay VED can result in penalties, fines, or even the immobilisation of the vehicle. The rates can be found on the government's official website, and they are categorised into bands based on CO2 emissions.

Different Vehicle Tax Bands

Vehicles are divided into different VED bands based on their CO2 emissions, with vehicles that produce less CO2 paying lower rates and those producing more CO2 paying higher rates. These bands are used to calculate the tax amount that vehicle owners are required to pay. Electric vehicles are often exempt from VED or pay a lower rate to incentivise the use of cleaner, greener technology.

Overview of the VED rates for different vehicle categories

-

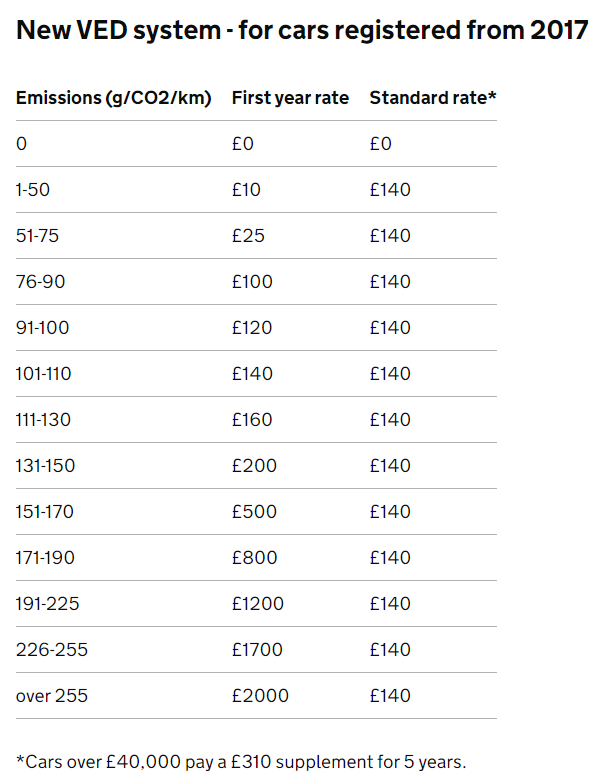

First-Year Rates: These rates apply for the first year after a vehicle's initial registration and are based on the vehicle's CO2 emissions. The rates vary from zero for electric vehicles with zero emissions to higher rates for vehicles with higher emissions.

-

Standard Rates: After the first year, vehicles are subject to standard rates, which are generally lower than the first-year rates. These rates are also based on the vehicle's CO2 emissions and can range from zero for zero-emission vehicles to higher amounts for high-emission vehicles.

-

Alternative Fuel Vehicles: Vehicles that use alternative fuels, such as LPG or natural gas, may have different VED rates, often lower than those for traditional petrol or diesel vehicles.

-

Vehicles Registered Before March 1, 2001: Vehicles registered before this date are taxed based on engine size, with different rates for different engine capacities.

-

Historic Vehicles: Vehicles that are over 40 years old and considered classic or historic may be exempt from VED.

-

Disabled or Disabled Passenger Vehicles: Some vehicles used by disabled people or for transporting disabled passengers are eligible for reduced or zero-rate VED.

VED rates UK (Image courtesy of https://www.gov.uk/)

FAQs about VED

What is the reason behind implementing Vehicle Excise Duty?

The UK government collects Vehicle Excise Duty as a tax in order to fund the maintenance and improvement of the country's road infrastructure.

How is the VED is calculated?

The calculation of VED takes into account various factors, including vehicle emissions, fuel type, and the date of purchase.

Are there any exemptions for VED?

Absolutely! There are exemptions available for specific categories of vehicles, such as electric and zero-emission vehicles.

Is Vehicle Excise Duty the Same as Car Tax?

Yes, Vehicle Excise Duty is often referred to as car tax. However, it is important to understand that the tax applies to all types of vehicles, not just cars.

Can I Pay Vehicle Excise Duty Monthly?

Yes, you can choose to pay your Vehicle Excise Duty monthly, annually, or semi-annually. Paying annually is often more cost-effective, as it may come with a discount.

What will happen if I fail to pay my VED on time?

Failure to pay VED on time can result in penalties, fines, or legal action.

Can I Transfer VED to Another Vehicle?

In some situations, you can transfer the VED to another vehicle you own. However, this process can be complex and may involve certain restrictions.

What is the impact of VED on the environment?

VED is a policy that encourages vehicle owners to choose low-emission or electric vehicles. By doing so, it helps to minimise the negative impact of transportation on the environment.

Conclusion On VED

To sum up, It is crucial for all vehicle owners in the UK to have a clear understanding of what Vehicle Excise Duty is and how it operates. The purpose of this tax is twofold: it helps to maintain our road infrastructure and ensures that all vehicle operators are equally responsible for its upkeep. By adhering to VED regulations, you can prevent incurring fines and contribute to the safety and proper maintenance of our roads.

To get more expert advice and stay informed about VED and other vehicle-related topics, follow our blog and visit our website regularly.

Get in touch for professional Car Body Repairs

We hope you enjoyed reading our article and found it useful. If you're looking for a professional car body repairs service, then bring your vehicle to our car body shop in Radcliffe near Manchester and our professional technicians will take care of it for you.

In addition, for your convenience, we offer a fully mobile service and can come to you. We cover the whole of Greater Manchester, Lancashire, Cheshire, Merseyside and Yorkshire.

If you’d like to get a price for our professional vehicle body repair service, then please get in touch with us now on 0161 667 0919 or by filling out our quick quote form to get a free, no-obligation quotation.

We have lots of 5 star reviews on Google from happy customers, so please feel free to check out our reviews.

Or contact our team to arrange a time to bring your vehicle in for an estimate. We look forward to restoring your vehicle and getting you back on the roads!